Suffice it to say that reporting is a challenge for multi-location DSOs. The more locations and brands, the more problems! Specifically, DSOs tend to struggle with questions about consolidation, data sharing and accessibility, and which key performance indicators (KPIs) matter most.

However, the end objective is usually the same: use data and reporting to inform critical business decisions. So here’s how I frame it for my many friends in the DSO world: you need to build a “global” marketing strategy with localized reporting. That means not only creating a strategy to share location- or brand-centric results, but selecting the tools that bring the data together and make reporting and data visualization far better.

Four Steps to More Successful Multi-Location Reporting

I’m talking about business intelligence (BI), a discipline that some consider the holy grail of DSO reporting. Writing for CIO.com, Mary K. Pratt and Josh Fruhlinger call BI the ability to “transform data into business insights.” In its own exploration of BI, the team at Tableau lists nine core processes, including data mining, reporting, performance metrics and benchmarking, and data visualization.

Within the context of multi-location DSOs, business intelligence can reveal opportunities for campaign spend optimization, improvements to the patient journey, and operational inefficiencies (to name but a few). To that end, here are some DSO-specific ideas for building a BI framework that drives better marketing decisions across brands and locations.

1. Consolidate You Campaigns and Data

I’ve seen DSOs find great success after unifying their display ad, email, social, SEO/website, paid search, and display data. This is one of the great benefits of data consolidation, the process of what Astera calls “amalgamating” various data, “eliminates redundancies, and removes inaccuracies before storing it in a single location, such as a data warehouse or database.”

Indeed, your approach to data warehousing will be a big part of your data consolidation efforts. Whichever approach you take to data warehousing, your goal should be to create a single source of truth—unified and reliable data that people across locations can use for various analytics, reporting, and related BI activities. Equally crucial to DSOs will be the ability to examine performance in local markets.

Beyond consolidation and data warehousing, invest in the right customer relationship management (CRM) solution. This is a critical part of centralizing marketing insights and tying in appointment booking information. It’s a staple among all of the client success stories in the DSO space. However, keep in mind that CRM implementation is not an easy process in healthcare—it can take many months, often requiring close coordination between legal, marketing, and operations.

How the Country’s Largest Orthodontic Group Increased Lead Volume by 73 percent

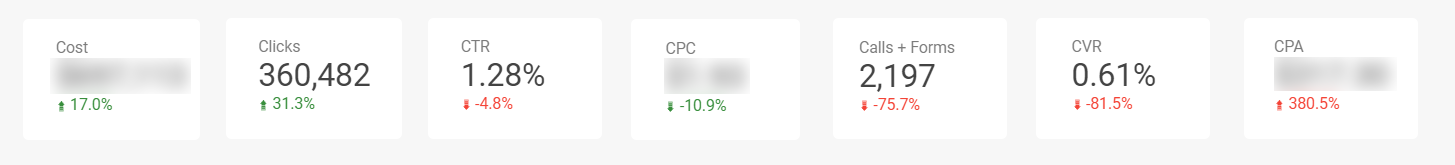

The team at Smile Doctors was at a crossroads: how to identify and optimize the right mix of advertising channels to support its plans for rapid expansion. One of the first steps we took was to restructure and consolidate their PPC campaign structure before implementing a full-funnel advertising strategy. Since then, Smile Doctors has enjoyed an 82 percent increase in PPC leads, a 28 percent increase in PPC conversion rate, and a 28 percent

decrease in CPA. We find that these are the KPIs that many multi-location DSOs use to evaluate their own performance.

Read the Smile Doctors case study.

2. Develop a Tiered Reporting Structure

There’s a difference between what needs to be managed on a national level versus a local level. We recommend developing a tiered reporting structure that allows you to examine both global performance as well as what’s going on in each local market.

Why? Simply because what works in one market might not work in another. Your billboard messaging or signage that’s resonating in Texas might not be in California. The same goes for digital ad creative, promotions, and so on. And DSOs absolutely need to be able to examine performance by the local market to make those finer, data-backed optimizations.

This requires a good understanding of your audience. What’s the reporting structure that will work best for them? On the one hand, your global performance reporting might be best suited for stakeholders at the VP or executive level. For regional marketing heads or even field-level marketing managers, the reporting needs, relevant performance indicators, and so on will likely be far more localized.

3. Determine the Reporting KPIs that Matter Most

When it comes to the KPIs you need to evaluate, think about what information is required at the national level to measure performance and ROI. What does the board need to know, for example? What data or reports do the local field marketing teams need to make better decisions? As I alluded to above, local field teams must have some control and will need insight to not only measure the impact of their marketing efforts but make decisions about what to change or adapt.

By examining the following areas, you should be able to distill the KPIs most relevant to your organization:

From digital advertising to SEO and everything in between, you’ll want to be clear about your objectives for each marketing channel you use. That goes for:

- Website and search engine optimization

- Pay per click advertising (PPC)

- Reputation management

- Social media and social media advertising

- Email marketing

- Content marketing

- TV, radio, and print (offline)

- PR, events, and sales

What’s more, you’ll want to develop benchmarks to help evaluate why you’re using specific channels and how you measure success on that channel. Here are some of the channel-level KPIs I see DSOs using in the real world:

- Conversions

- Organic traffic

- Cost per lead (CPL)

- Marketing-attributed revenue (by channel)

It might also be valuable to evaluate particular regions or markets against your performance indicators. At the very least, you’ll want to build a data analytics and reporting operation capable of regional evaluation—now or when future expansion does happen. This kind of analysis is less about creating market- or region-specific metrics (though that might be necessary) but viewing your available data through the lens of market or regional performance. But, again, that kind of flexible reporting and data visualization will require a mature approach to BI.

You can also measure performance based on the type of your new locations. For example, you might find value in evaluating your mergers, acquisitions, or de novo acquisitions against different benchmarks. This can help guide future investments, as well as where to direct marketing spend. You’ll likely evaluate location types on:

- Scheduled appointments

- New patients

- Services rendered

- Overall CPL

- Marketing ROI

4. Create Report Templates for Better Alignment

There’s always some give and take concerning the level of autonomy you give to each local or regional marketing team. However, as part of a more centralized and consolidated business intelligence model, you might consider creating and sharing report templates across locations and brands.

This will help create alignment in a few ways:

- Teams will consistently report on the right KPIs by default

- You’ll democratize data access and visibility across the organization

- Your marketing teams will spend less time design reports and more time analyzing and acting on them

- You’ll save time ramping up reporting as you expand to new locations

Sarah Cucchiara, SVP of Channel Marketing Strategy writing for BrandMuscle, calls this practice “providing for your flock.” I think she means putting each of your locations in the best position for success. For obvious reasons, we Flockers here at Cardinal rather like this characterization.

Build Good Multi-Location Reporting and the Insights Will Come

When talking about reporting for DSOs, I like to share stories from the trenches—case studies from our own portfolio. One case study, in particular, embodies the need for better multi-location reporting. When the DentalWorks team first connected with my team at Cardinal, they faced a common problem: their campaigns weren’t targeting the right people, at the right time, with the right message.

Now, you can read the full DentalWorks case study to see how we solved this problem—how we rolled out an ROI-focused approach to PPC ads that increased leads by 40 percent. But DentalWorks has 160 locations across the United States. So the problem they wanted to solve was indicative of a deeper one (and the topic of this very blog post): to improve their PPC campaigns, they needed to get a lot more out of their data.

The same goes for Made Ya Smile Dental, Klement Family Dental, and Sage Dental—across multi-location dental groups, large and small, you’ll find robust and centralized reporting among the performers and trendsetters.