Nobody is particularly interested in portfolio companies with data problems. Without reliable operational and financial data, it can be quite challenging to manage the performance of portfolio companies, make investment decisions, or create value post-acquisition. This article provides some best practices for building a data-driven marketing operation to drive serious growth.

Three Common Obstacles to Better Data & Analytics

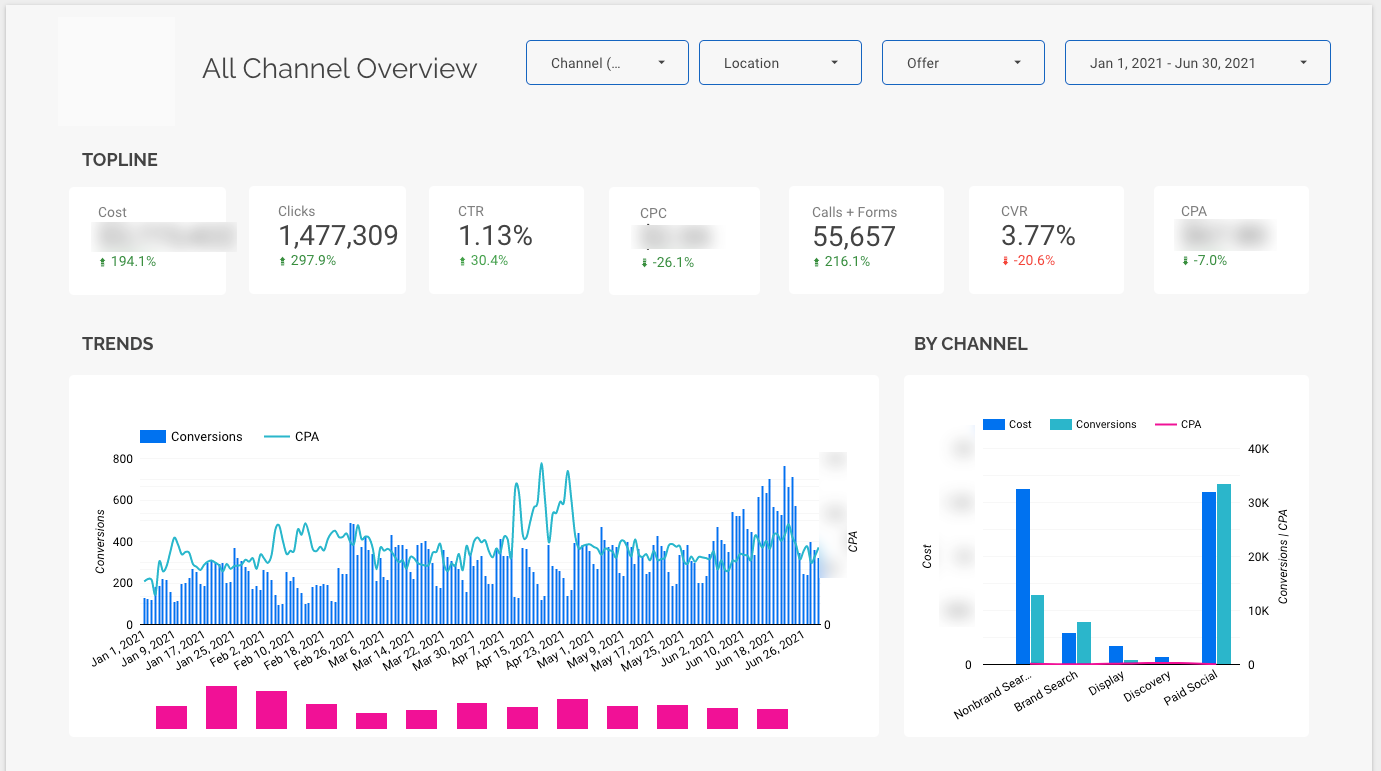

Building a data and analytics operation, including infrastructure and headcount, is no small undertaking. First and forever, private equity firms need to track their marketing investments, determine ROI, make model projections, and so on. As part of these efforts, firms will need to orchestrate closed-loop marketing analytics, real-time performance, and key software integrations.

As to why this can be a challenge for private equity firms, I decided to ask someone much more accomplished than me: Rich Briddock, our SVP of Performance Marketing. In our recent talk during Podcast Ep. 21 – Build a Foundation for Better Marketing Measurement, Rich cites three primary challenges to better data and analytics:

1. Tracking

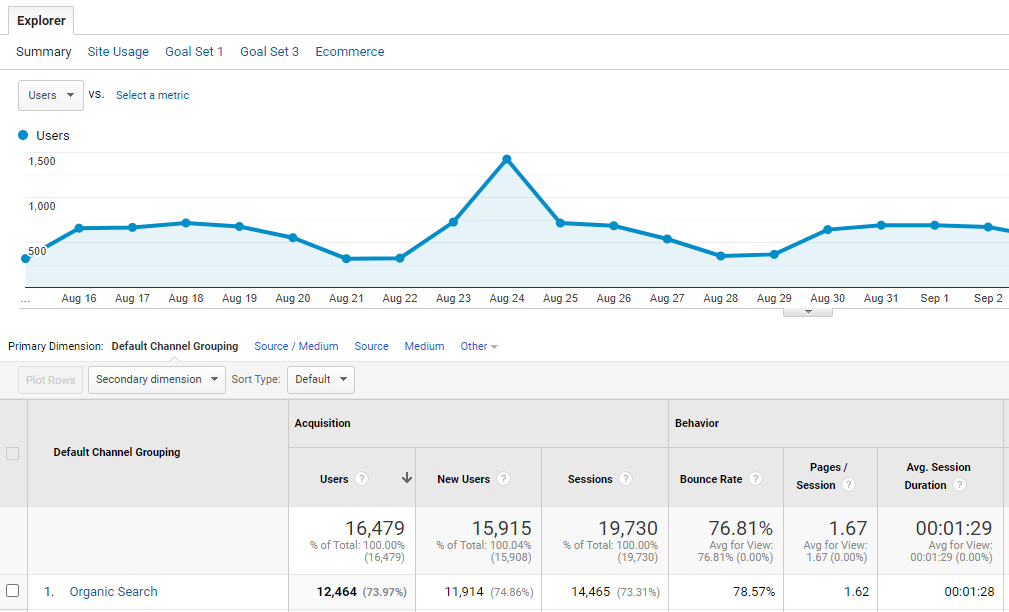

“They just don’t have the right tracking set up to measure the leads that are happening on the website or phone calls that they’re driving from their marketing efforts,” says Rich of many private equity firms. “They really just don’t even have visibility into that initial level of checking form-fills correctly back to the marketing channel like Google Ads, Facebook Ads, display efforts, and tracking phone calls effectively back, because they don’t have a tracking solution in place.”

There are a couple of common ways to track the performance of a marketing campaign:

- Content consumption and engagement

- Advertising reach and costs

- Conversion rates

- Social media engagement

- Organic rankings and traffic

- Lead attribution

2. Closing the Loop

“The second one is more common, but it’s more difficult to solve,” says Rich. “There’s no tie back to the actual outcome of those leads once they’re driven from the website. I drive 100 form fills, I drive 500 phone calls, but what happens to them? Do they become 600 patients, or do they become 12 patients?”

This is called closing the loop, a common concept in the marketing and data analytics worlds. This entails taking the revenue that results from a “conversion” or close sale and attributing it back to the channels, campaigns, keywords (and more) that influenced it.

3. Attribution

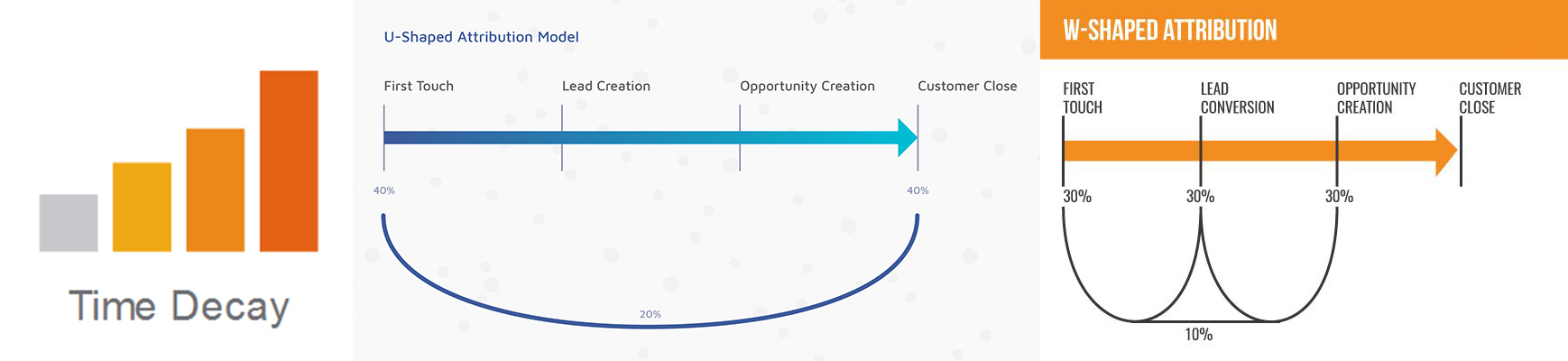

The ability to deliver this kind of reporting from start to finish provides managing firms a far more accurate picture of the performance metrics that really matter. To get there, however, you’ll probably require some kind of attribution model to see which activities, campaigns, teams, and so on create results. Here are three common attribution models for marketing:

- Time-Decay: As the name suggests, some credit is assigned to every “touch” that led to a conversion, with credit weighted in favor of more recent touches.

- U-Shaped: Under this multi-touch attribution model, the first and last marketing touches get the most weight, with the middle touches receiving less weight.

- W-Shaped: This model gives 30% credit to the first, middle, and last touches, then 10% to the remaining touches in between.

Best Practices for Building Data-Driven Marketing

To move a portfolio company toward a more data-driven marketing strategy, we recommend the following best practices:

1. A Foundational Marketing Analytics Team

Who are your data acquisition specialists, engineers, quality controllers, scientists, analysts, and interpreters within each portfolio company? Who, if anybody, can you tap to oversee the overhaul of a company’s marketing data operations or to build them from scratch? What about connecting data sources to disparate systems and dashboards for real-time reporting?

You’ll likely need some combination of data engineers, data scientists, and insights specialists to analyze data findings, relate them to strategic objectives, and then communicate those insights to executives. In some cases, it makes more sense to bring in a third-party services group to act as an extension of the existing analytics team (or to serve as the entire team itself).

2. Clearly Defined Performance Indicators

From the portfolio management perspective, you’ll want to identify the most important KPIs without spreading yourself too thin. In other words, which KPIs not only support the company’s strategy but sustain it until it’s time to make an exit decision?

Typically, “everything under the sun” isn’t the right answer.

For example, high-intent lead acquisition might be a top indicator for a multi-location healthcare portfolio. Within the eCommerce space, cost per conversion is typically a leading indicator. For subscription services, monthly recurring revenue (MRR) is a big one, as is churn.

Regardless of which indicators you arrive at, they’ll be key in assigning stakeholder responsibility, creating alignment, and guiding certain marketing investments.

3. No Organizational Silos

Marketing silos are all too common in multi-location organizations, especially as they relate to data. This can create major obstacles to the centralization, democratization, and accessibility of reliable data. Data silos are typically characterized by:

- Inadequate or non-existent communication channels between marketing/data teams

- No centralized way to share data insights and collaborate

- Lack of alignment around broader organizational strategies

- Not mapping the high-level KPIs that are important to the managing portfolio

- Patchwork data systems scattered across various locations

Sound familiar? Cody Lee, Vice President of Summit Partners, had some interesting insights into silos during our recent Ignite podcast:

“Being able to measure results, publish results, and share results is one of the best ways to get buy-in,” he said. “A CEO might not understand a paid search campaign or an SEO campaign, but they can understand your lead volume from inbound went up 100%, and those leads drove 20% increase in inbound revenue generation. […] A lot of it is understanding who your audience is and translating what you’re doing.”

The kind of closed-loop reporting and data visibility that Lee describes here is challenging to achieve without addressing underlying data silos. And yet, it is crucial to understand what’s working, what’s not, and where to invest the next dollar to create the most value.

4. Integrated Marketing Technology that Swiftly Connects the Dots

To achieve the kind of tracking, closed-loop marketing, and marketing attribution models you need for sustainable, high-speed growth, you need a lean, mean, integrated tech stack. Yet, a given portfolio company might have dozens of core systems already in place, such as customer relationship management (CRM) software, email marketing solutions, and website platforms.

How are you going to bring in data from all of these sources and use it to build the data products your teams need to drive growth?

Some firms strategically deploy Application Programming Interface (APIs) to connect various systems to various data sources. While this can certainly work, it can also require specialized expertise for ongoing updates, maintenance, and troubleshooting. Others leverage existing integrations, but those aren’t always available.

In the end, you’ll need to perform a comprehensive audit of a company’s technology to understand how marketers can collaborate with IT to connect disparate systems. Says Rich Briddock from the same interview cited above, “Seeking perfection on instrumentation or analytics is in many ways, a fool’s errand sometimes, and you end up wasting more time. There’s a real balance that you need to strike.”

Priority One: Leverage Data to Accelerate Value Creation

To be fair, the best practices I’ve laid out above would benefit most organizations. But building a data-driven marketing strategy can be particularly advantageous for private equity firms. Establishing a mature data operation within a portfolio company can help you determine and report on ROI for marketing activities across the portfolio, for one. It can also help firms make decisions about where to invest their next dollar or how and when to make a successful exit.

After all, there’s always the investors to keep in mind. Those investors want to see ROI statements, value outcomes, and reliable performance metrics. This must be why research from PwC Germany predicts that, in no more than ten years, all private equity firms will have “analytics and data experts or data science teams working on value creation projects in portfolio companies.”

They simply can’t afford not to.